The UK government has announced National Minimum Wage changes which will come into effect in April 2025. These changes are essential for both employers and employees to understand to ensure compliance and avoid potential legal and financial repercussions.

This blog will outline the new rates, explain their implications and provide actionable steps for employers and employees to prepare for these adjustments.

New National Minimum Wage for April 2025

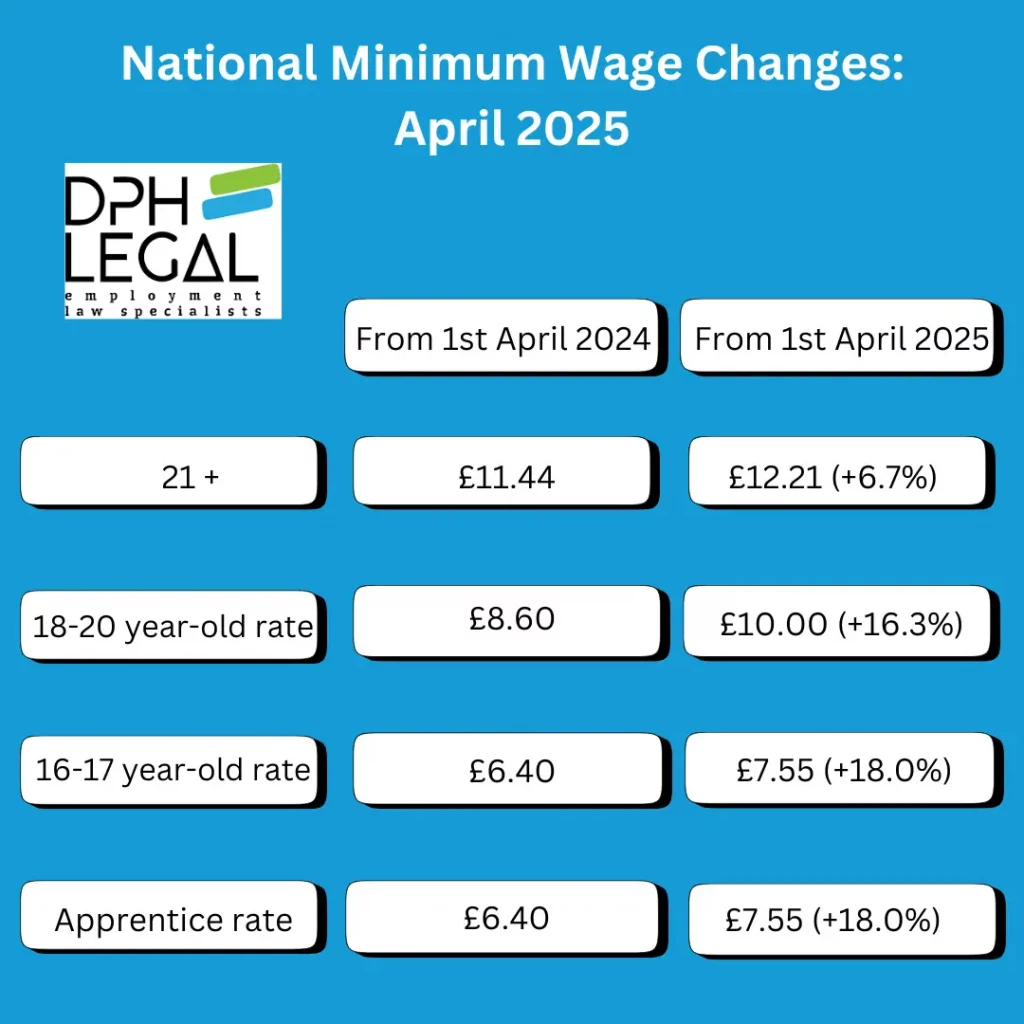

As of April 2025, the following wage rates will apply:

- Age 21 and over: £12.21 per hour, a 6.7% increase from £11.44

- Age 18 to 20: £10 per hour, a 16.3% increase from £8.60

- Age 16 to 17 and apprentices: £7.55 per hour, an 18% increase from £6.40

These increases are part of the government’s ongoing effort to provide fair wages and address the rising cost of living. While this is great news for workers, it also places a responsibility on employers to ensure their pay structures align with these changes.

In the following sections, we will:

- Explain why the changes are important and their impact on businesses and workers.

- Detail what employers need to do to comply with the new regulations, including updating payroll, reviewing contracts and maintaining accurate records.

- Highlight employees’ rights and the steps they can take to ensure they are receiving the correct pay.

Do Companies Have to Pay Minimum Wage?

Companies are legally required to pay at least the minimum wage to all eligible workers. This obligation applies to full-time, part-time, zero-hour, agency and casual workers. Employers who fail to meet this requirement can face severe financial penalties, legal action, and reputational harm.

Why These Changes Matter

The National Minimum Wage is a legal requirements that ensure workers are paid fairly for their time and effort. Failure to comply can result in penalties for employers, harm employee morale and damage a company’s reputation. For employees, understanding these changes can help ensure fair compensation. They provide the financial security they deserve.

Steps for Employers

1. Update Payroll Systems

The first and most critical step is to update payroll systems to reflect the new rates. This includes:

- Adjusting regular hourly rates

- Calculating overtime, bonuses and other pay-related factors

- Ensuring compliance for all workers, including those on variable or zero-hour contracts.

- Regular audits of payroll systems can help identify and correct any discrepancies before they become an issue

2. Communicate with Employees

Transparency is key. Inform your workforce about the upcoming changes to:

- Avoid confusion and misunderstandings

- Foster trust and demonstrate your commitment to fair pay

Use meetings, email updates or internal newsletters to share this information, ensuring that all employees are aware of their new wage rates.

3. Review Working Hours and Contracts

Employers should assess:

- Existing contracts to ensure compliance with the new wage rates

- Fair pay practices, particularly for workers on flexible or zero-hour contracts

By reviewing and updating contracts, employers can avoid potential disputes and ensure their practices align with legal requirements.

4. Keep Accurate Records

Employers are legally required to keep records proving that the minimum wage is being paid. These records must be maintained for at least six years and should include:

- Employee pay slips

- Working hours logs

- Any agreements regarding pay rates or hours worked

Having thorough documentation will protect your business in the event of an audit or dispute.

5. Use Wage Calculators

To ensure accuracy, use the minimum wage calculators available on the government website. These tools can:

- Help verify that all employees are receiving the correct pay

- Identify any underpayments that need to be rectified

Eligibility for the National Minimum Wage

Eligibility for the National Minimum Wage in the UK depends on age, employment status and type of work. Workers aged 18 to 20 qualify for the National Minimum Wage. Those 21 and over receive the higher National Living Wage (A higher rate designed to ensure workers aged 21+ earn a wage closer to the cost of living).

Eligible groups include full-time, part-time, zero-hour, agency and casual workers, as well as apprentices. Exemptions include the self-employed, volunteers, family members working in the employer’s home and students on short-term placements. Workers must be legally employed in the UK.

Steps for Employees

1. Check Your Pay

Employees should take proactive steps to ensure they are receiving the correct wages by:

- Reviewing their pay slips.

- Using the minimum wage calculators on GOV.UK.

Understanding your rights is the first step in ensuring fair treatment in the workplace.

2. Address Underpayments

If you suspect that your employer is not paying the correct wage, take the following steps:

- Notify Your Employer: Raise the issue with your employer to allow them to correct the mistake

- Request Back Pay: Employers are obligated to repay any underpayments

- Report to HMRC: If the issue is not resolved, report it to HMRC by emailing voluntarydeclaration.nmw@hmrc.gov.uk

3. Know Your Rights

Understanding your legal rights under the National Minimum Wage ensures you can take action if your employer is non-compliant.

Penalties for Non-Compliance

Employers who fail to meet minimum wage requirements face significant consequences, including:

- Financial Penalties: Up to 200% of the underpayment, capped at £20,000 per worker

- Reputational Damage: Being publicly named and shamed on the government’s list of non-compliant employers

- Legal Action: Workers can take employers to an employment tribunal to recover unpaid wages

It is in every employer’s interest to address these changes proactively to avoid such outcomes.

Contact our Employment Solicitors

The April 2025 changes to the National Minimum Wage are a step towards fairer pay across the UK. For employers, compliance is not just a legal obligation but an opportunity to build trust and strengthen employee relations. For employees, understanding these changes ensures you receive the compensation you are entitled to.

By taking the necessary steps outlined in this blog, both employers and employees can navigate these changes smoothly and confidently. Whether it’s updating payroll, reviewing contracts, or using online calculators, preparation is key to ensuring a seamless transition.

For expert advice on minimum wage law and compliance, contact our employment solicitors at DPH Legal. Our team is here to help you understand your obligations and protect your rights.